A Helicopter Powered Economy

A HELICOPTER POWERED ECONOMY

by Paul Cormier, President, Cormier Strategy Advisors Inc.

September 2009

Abraham Lincoln once said, “I will try to correct errors when shown to be errors; and I shall adopt new views so fast as they shall appear to be true views.” Well I want to tell you that I was wrong. While I have in several articles on this site, and for my subscribers at csamarkettiming.com, expressed my belief that the economy would recover in the second half of the year and specifically that the recession would end in the third quarter, I had also noted that I thought a recovery would be mild. I am here to tell you that I have adopted a new view. I believe that the recovery is going to be much stronger than most people think.

Late last year when the financial system was crumbling around us, it appeared we were headed for a depression. And maybe we were. But the world owes a debt of gratitude to Federal Reserve Chair Ben Bernanke. Bernanke had the answer that saved us from the awful fate that many of our parents and grandparents lived through. Bernanke had studied the Great Depression in depth, understood its causes and the policy mistakes that caused it to last so long. Even prior to his appointment as Fed Chair, he became known as “Helicopter Ben” for agreeing with economist Milton Friedman that a monetary authority could escape a deflationary sprial by bypassing financial intermediaries to give money directly to consumers or businesses (which came to be known as “helicopter money”, portraying the image of a central banker dropping money from a helicopter). He knew he had to prevent deflation to avoid another Great Depression and did precisely this by flooding the economy with money, buying assets that investors weren’t willing to buy and letting people know that the financial system was backstopped.

It worked. Not only does it appear that we are coming out of the recession, but the helicopter’s whirlwind is lifting the whole economy more than anticipated. I very carefully monitor an organization called the Economic Cycle Research Institute (ECRI). They are a consulting firm that specializes in economic forecasting. They have a number of indicators that, like my stock market forecasting indicator, use the lessons of history to try to predict what the future holds. They have been extremely successful at predicting recessions and recoveries for decades.

Their best known indicator is called the Weekly Leading Index (WLI) and in recent weeks it has risen to record levels. This indicator is telling us some important things. It is telling us the recovery is at hand. It is telling us not to expect a double-dip recession anytime soon, contrary to the forecasts of many economists. And it is telling us to expect to a far more robust economic recovery than almost anyone expects.

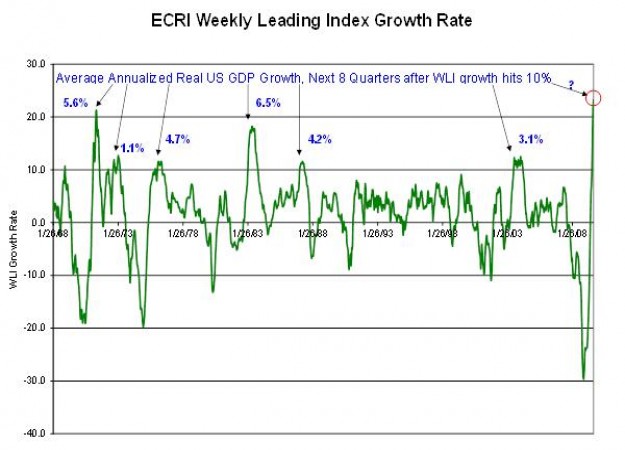

The following chart shows the ECRI WLI since the late 1960s. You will notice that when the growth rate for the WLI spikes above 10% there is always positive real US GDP growth when looking at the average of the next eight quarters. You will also note that when the WLI growth rate spikes at or near the 20% level, recoveries have been much stronger. The WLI growth rate has spiked above 20% in recent weeks, setting new all-time records for the index. Many economists are forecasting only 2% growth for the US economy in this recovery and several think 4% is unimaginable. This data suggests that predictions of a 4% recovery are probably on the light side and that 5% or higher is a definite possibility.

Of course the stock market is already pricing much of this in. People often forget that the stock market is a forward indicator of the economy – in fact ECRI uses the stock market as one of the factors in calculating its WLI. Waiting for economic fundamentals to improve is generally not a good way to time investment or business decisions and that is why we built our stock market forecasting indicator (www.csamarkettiming.com) on market data instead of economic data.

So what does one do with this knowledge? Successful organizations, managers and investors are successful because they don’t skate towards the puck; they skate to where the puck is going to be. Organizations need to understand how stronger-than-expected growth will impact them operationally, financially and in their marketing efforts. Does the organization have sufficient human resources capability to meet the higher demand for its goods and services that stronger economic growth will induce? Is the organization locking into cheap financing today while it is still available? Will the company position its products to pick up new customers in an environment where they may be susceptible to change?

The coming recovery represents great opportunity to those courageous enough to act early while addressing gaps is still easy and cheap. History can be a powerful guide when you learn its lessons.

Paul Cormier is President of Cormier Strategy Advisors Inc., a firm which provides clients with strategic consulting, project management and short-term management services.